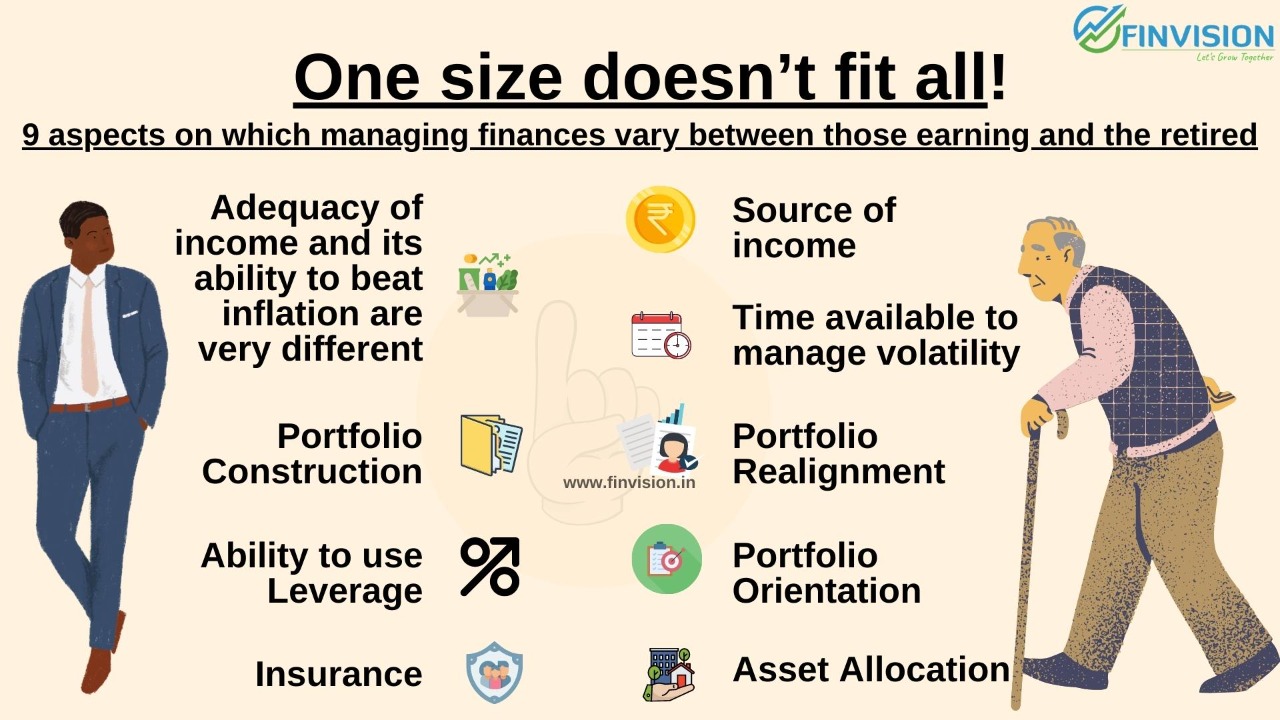

Personal finance principles aren’t universal and in addition to individuals financial goals, risk appetite and investment horizon, one’s life stage also has major influences on one’s personal financial decisions. Here are nine such aspects on which the management of finances between the earning phase and retirement phase differs:-

Personal finance principles aren’t universal and in addition to individuals financial goals, risk appetite and investment horizon, one’s life stage also has major influences on one’s personal financial decisions. Here are nine such aspects on which the management of finances between the earning phase and retirement phase differs:-

1. Source of income:

In the earning phase: The primary source of income is the job, profession or business. The skills one possess, and the demand for those skills determine how well one can perform and earn. Human asset is the main contributor. In retirement: The income is primarily generated from pensions, or from the assets or investments. While many may argue that not having a job is risky, in reality, control over income is better in retirement. Pension does not get impacted by performance appraisals, nor is it at risk from losing a job. It remains as long as one is alive. Returns from investment are subject to risk, but a large enough corpus and a sensible investment can fix that problem.

2. Adequacy of income and its ability to beat inflation are very different:

The earning phase enjoys ability to acquire new skills and explore new avenues to enhance incomes. Retirement is constrained by the ability to modify income levels. Pensions and DA enhancement/ indexation to inflation may not be adequate. Thus building of sufficient corpus before retirement and smart asset allocation and investment management post retirement is important.

3. Time available to manage volatility:

In the earning years: Presence of a potentially increasing income stream offers better cushioning in making portfolio construction and rebalancing decisions. For example, if adequate income is available and some savings are possible every month, an earning member’s portfolio can be overweight equity.

A retired person’s portfolio cannot overdo equity for the needs to generate income and to hedge against serious fall in equity assets.

4. Portfolio Construction:

Earning person’s portfolio is more capable of making tactical portfolio reviews and changes.

A retired person’s portfolio needs to be more strategically managed.

To illustrate: Someone with a steady salary and investible surplus is always in a position to deploy funds into a bear market. A retired person will not have this tactical advantage, as they may have no liquid funds when an opportunity presents itself.

5. Portfolio Realignment:

Generally the earning member’s investment portfolio has no income requirement, thus they can allow profits to run and focus on cutting losses when they occur.

Retired person’s portfolio may have to be tuned to realise gains and reallocations. Booking profits out of growth assets and moving them to the income portfolio is often needed to keep incomes and to prune equity allocations and manage volatility. Laddering and rebalancing are precious strategies for the retired.

6. Ability to use Leverage:

An earning member can use leverage to enhance their gains and to fund their income needs without liquidating the portfolio. They can borrow against their assets, using their incomes to repay these loans while protecting their assets.

A retired person’s ability to borrow and service loans is limited. A retired person even with an income surplus might be reluctant to borrow, and will generally be conservative in spend as well as investment allocation.

7. Portfolio Orientation:

An earning member’s portfolio benefits from being oriented towards defined financial goals. The required rate of return and tuning or asset allocation thereof, is defined by the funding required for those goals.

A retired investor enjoys the luxury of not having to worry about funding financial goals. The corpus that gets left behind for heirs can be treated as residual after their needs are met.

8. Asset Allocation:

Earning investors: May be keen on acquiring assets and wealth creation, and thus skewing their portfolio while trying to do so. Like someone buying a house in early life, will most likely have all their wealth in one property.

Retired investor: Should ideally have a balanced mix of assets- equity, debt and property. If their portfolio is also skewed, it may become a constraint in generating income and protecting from inflation.

9. Insurance:

A young earning investor needs life insurance first, before building assets. Health insurance may be provided by the employer and is available at better rates. Also, may not have built adequate assets yet, hence insurance would ideally be the protection until then.

Retired person needs no life insurance, though the health insurance needs may be high and expensive but may be in a position to use their assets if an emergency arises.

Most of the above aspects are generally well known. The listing here is only to contrast how the fundamental principles with respect to income, risk, return, growth, asset allocation differ for those in the earning stage and the ones who have retired. These differences should drive how portfolios are constructed, reviewed, rebalanced and managed.

In personal finance, generalisation doesn’t ever work; Every person has unique financial goals, risk appetite, investment horizon, constraints & spending habits, therefore, so should be their choice of investment instruments and asset allocation.

To know more, kindly use this link to register for our 31 July 2022 webinar on Financial & Retirement planning: https://forms.gle/WXvrhmSFpDVN4gny9

Do share this in your social circles for the fraternity to benefit.

For all your financial, retirement, investment & insurance needs contact Team Finvision at 011-40044366 / +91-7508055826

(Source: Various financial magazines and online platforms)