“Making returns in the market is simple, but not easy”

In view of the above, it is prudent to invest in equities via MFs, which have a well-diversified portfolio and professional fund management expertise.

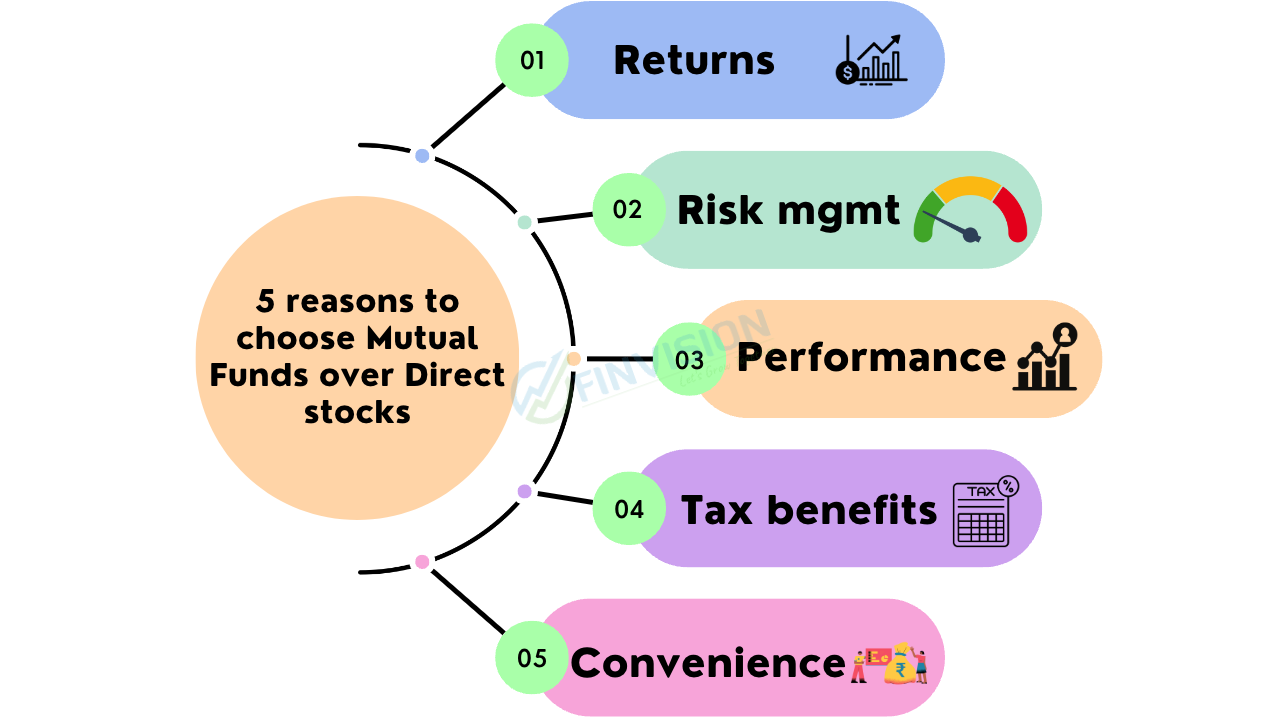

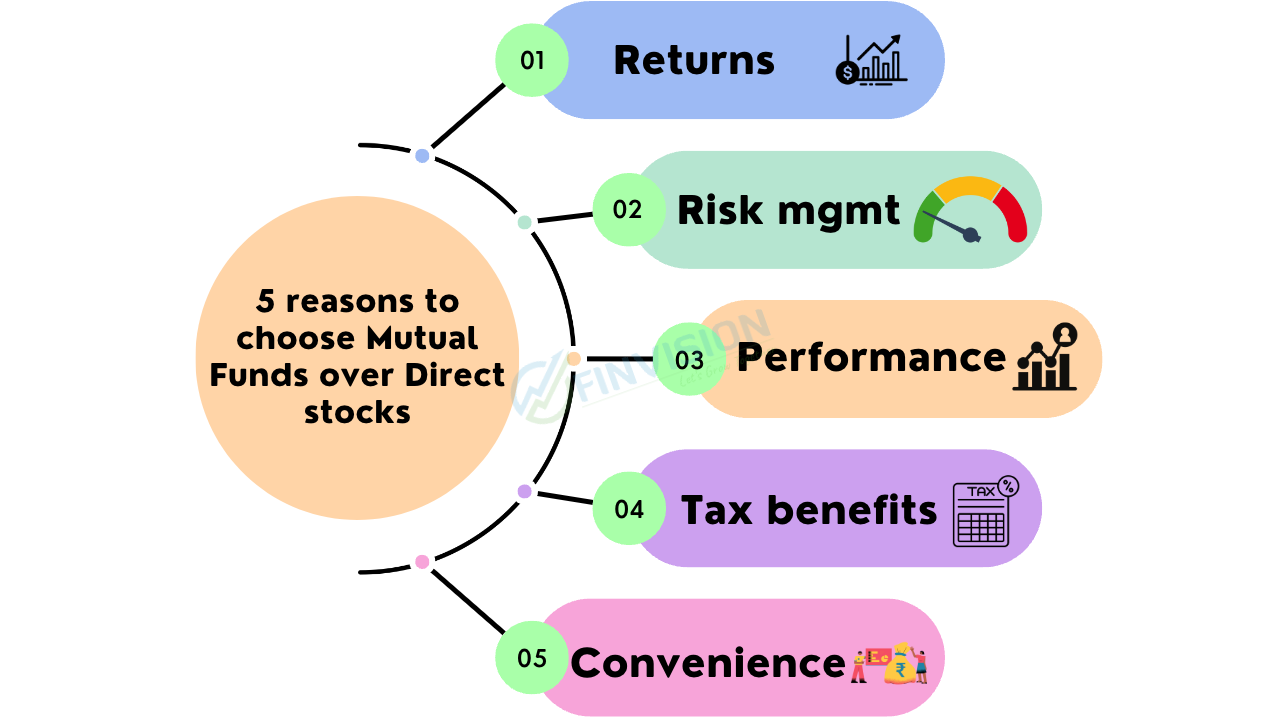

Here are five reasons why investing in mutual funds can make you richer than investing in direct stocks:

1. Returns: Perhaps the dilemma for a novice investor starts here. Practically speaking, as compared to equity, mutual fund returns are regular, carry lower risk, and offer the benefits of compounding. Also, in the case of a diversified portfolio, the returns don’t fluctuate as much. In comparison, since direct equity is invested in individual stocks, your returns can see a lot of surges and declines within short spans.

2. Risk Management: In mutual funds, the fund manager ensures investment in different sectors and is tracking the market all the time. Whereas, direct stocks come with higher risks. To diversify here would mean investing in many different industries with a considerable amount of invested capital. Yes, for investors who have the appetite, time to monitor, and know the market, the high returns are definitely a reward. However, they come with a considerably high amount of risk.

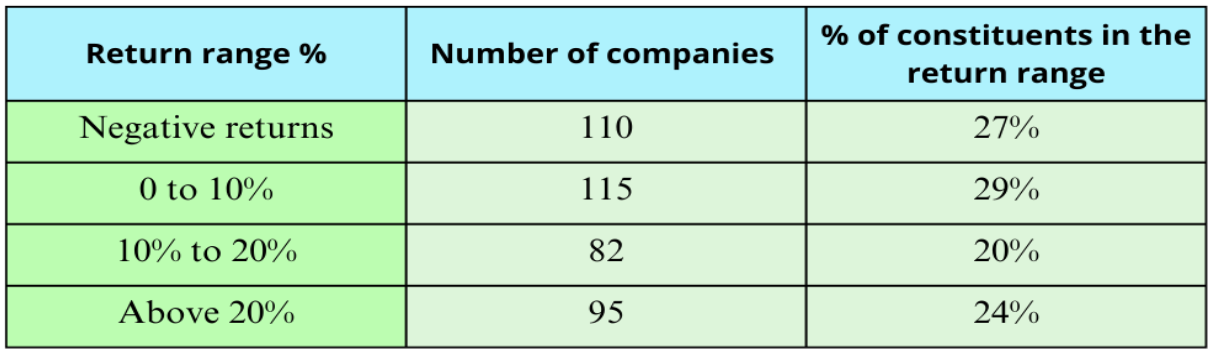

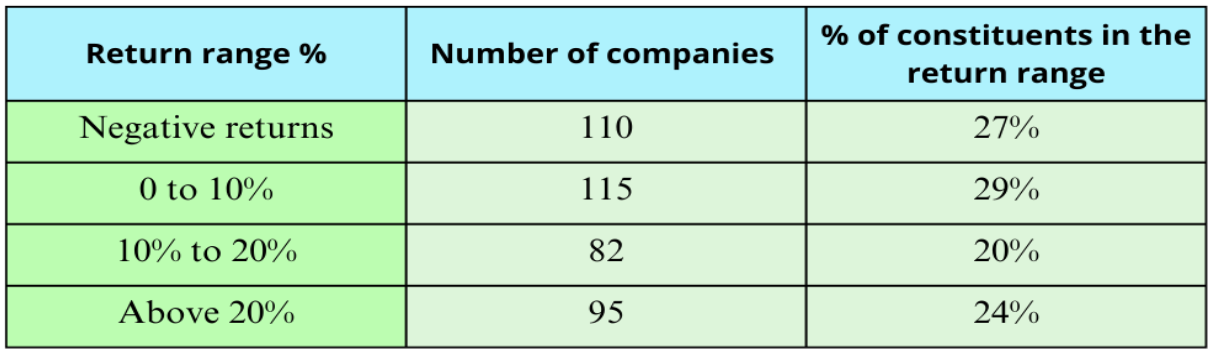

3. Performance: Both direct equity and mutual funds are based on the same company stocks being traded in the stock market. But the effects of the market flip-flops are different on both. In mutual funds, an underperforming stock gets balanced by another well-performing stock. Hence, the gains are not affected to a huge degree. But, in direct stocks, if that one underperforming stock is where most of your money is invested, that would mean your returns will become very low. Unless of course, you check your stocks very efficiently and such situations are foreseen, which is rare.

4. Tax Benefits: Mutual Funds can provide tax benefits to an investor under Section 80 C if invested in equity-linked saving schemes (ELSS). This is not something direct equity investment can boast of. Also, stock investing comes with a short-term capital tax; that has to be paid if the stocks are sold within one year. But, there is no such liability with mutual funds.

5. Convenience: Investing in mutual funds makes control and monitoring much simpler. You will be monitoring the fund schemes and not the individual companies. Meaning saving time and resources to research stocks to invest into.

Direct stock investing offers the potential for higher returns, but it comes with increased risk and reduced probability of making returns.

To wrap it up: Investment preferences are like taste buds: to each his/ her own. The food that appeals to one might not appeal to the other; likewise, for the choice of an investment vehicle. Both direct stocks and mutual funds have their own merits and considerations. Direct stock investing offers the potential for higher returns, but it comes with increased risk, diligent research, and expertise. Ultimately, the choice between direct stocks and mutual funds depends on your risk tolerance, investment goals, time availability, and expertise. Remember to seek professional advice and conduct thorough research before making any investment decisions.

Happy Investing!

We shall be holding an online meeting on the subject at our Finvision Frontline Telegram Group. Link to join and share queries: https://t.me/RMiB6j1HPec1ZjVl

Link to register for the Financial and Retirement Planning Webinar scheduled on 30 July 2023: https://forms.gle/jiHGNe3XuW3wyst96

For all your Financial and Retirement planning needs contact #TeamFinvision at +91-7508055826 / 9654341212 or email us at: info@finvision.in