What is Financial Freedom?

A state when you have sufficient wealth to fulfil all your financial goals, live on and maintain the current lifestyle without having to depend on income from some form of employment.

Changing definition of Financial Freedom:

Till few years back, financial independence was synonymous with retirement. But now and specifically for the millennials, financial freedom means not having to work 45 hours a week for 40 years. The young generation wish to be financially independent early so they can enjoy the latter half of life in the company of their loved ones and doing something of their own or that they enjoy.

‘Financial freedom is available to those who learn about it and work for it’- Robert Kiyosaki

Here is a quick guide to realise all your dreams, retiring early and attaining financial independence:

1. Do the maths: For all your financial goals like Children education, marriage, starting a business, etc, calculate the amount that you will need for each of those goals in todays environment. Even for your retirement, figure out how much wealth you will need to maintain your current lifestyle after your steady monthly salary/ income comes to a halt. Start by calculating your current monthly expenditure and extrapolate this over the next 20-30 years (depending on your target retirement age) by taking inflation into account.

Once you have arrived at reasonable figures and quantified your financial goals, analyse your current savings and investments, and figure out how much more money you will need to generate for those goals. Once you are aware of the corpus you must aim for, you can easily decide on the savings required and the most optimum investment avenues to select.

2. The best day to start savings and investments was yesterday: the next best day is today!

At younger ages, saving and investing for long term goals may be a low priority, and building a retirement corpus is probably the last thing on your mind. However, consider this: today you may be young, independent. and with fewer responsibilities. Over time this will change; your responsibilities will increase and so will your expenses. So it’s easier and better to start saving a part of your salary today than it will ever be in the future. Moreover, as the years pass and you edge closer to your financial goals and retirement, the stress to achieve those goals and establish a financially secure retired life will weigh heavily on you.

3. Leverage the power of compounding: While it may sound complex, the power of compounding (or the 8th wonder), simply refers to growing your wealth by earning on your previous earnings. But what many fail to understand is that a small amount compounded over a long period generates much higher returns than a large amount compounded over a smaller period.

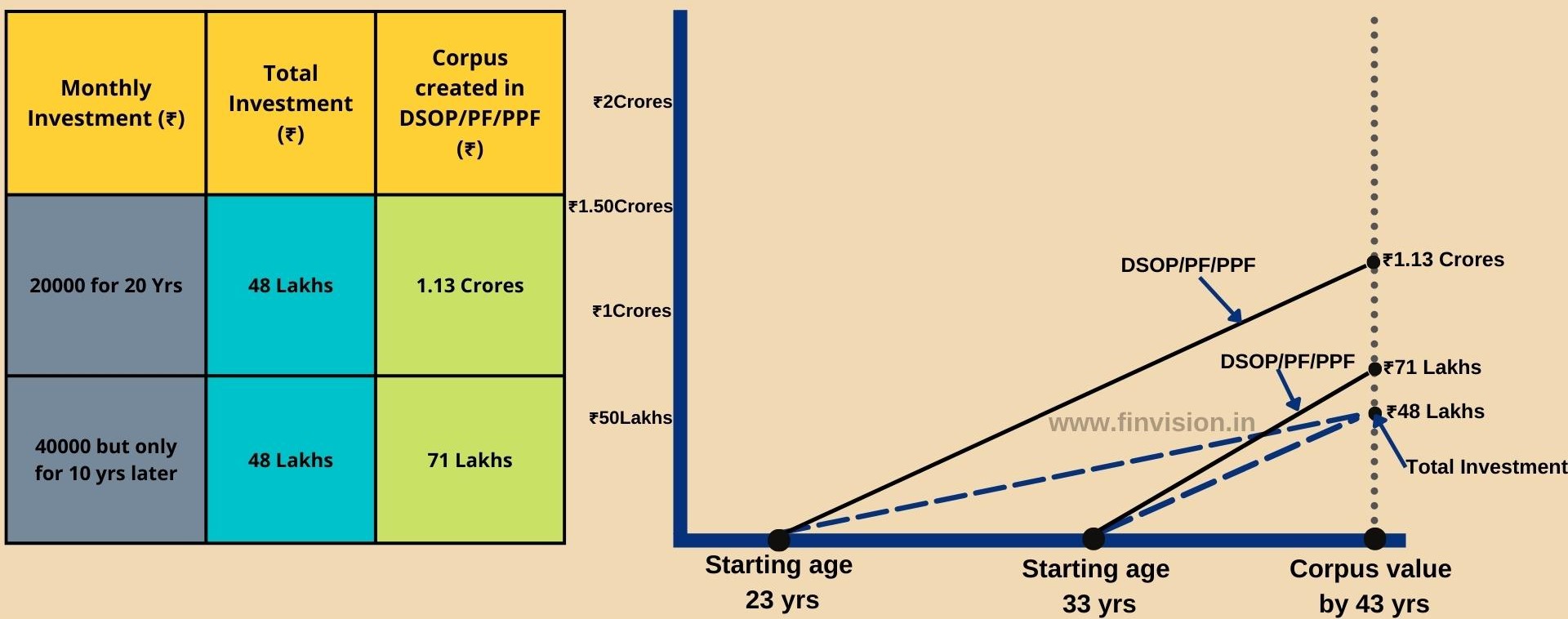

Let’s understand this with an example: Maj Ram and Maj Shyam both got commissioned in the same year. While they had similar training and schedule, their financial choices were vastly different. Maj Ram wanted to retire by 43 and take become an entrepreneur by starting his own venture. Maj Shyam must have had some dreams too, but he never made an effort to turn them into reality. While Maj Ram began investing ₹20000 every month for his retirement (start own venture) goal from his first salary at the age of 23, Maj Shyam realised the importance of investments only later on in life and started with ₹40000 a month after he turned 33 yrs.

At the age of 43 years, though both will be investing an equal amount of ₹48 Lakhs, however Maj Ram’s earnings will be far higher. Starting early, helps you benefit from compounding and can make your money grow faster to achieve your financial goals much earlier.

Let’s look at how much they both will earn from their investments in a simple and traditional instrument like DSOP/PF/PPF based on the past ROI/ Interest rates.

Let’s look at how much they both will earn from their investments in a simple and traditional instrument like DSOP/PF/PPF based on the past ROI/ Interest rates.

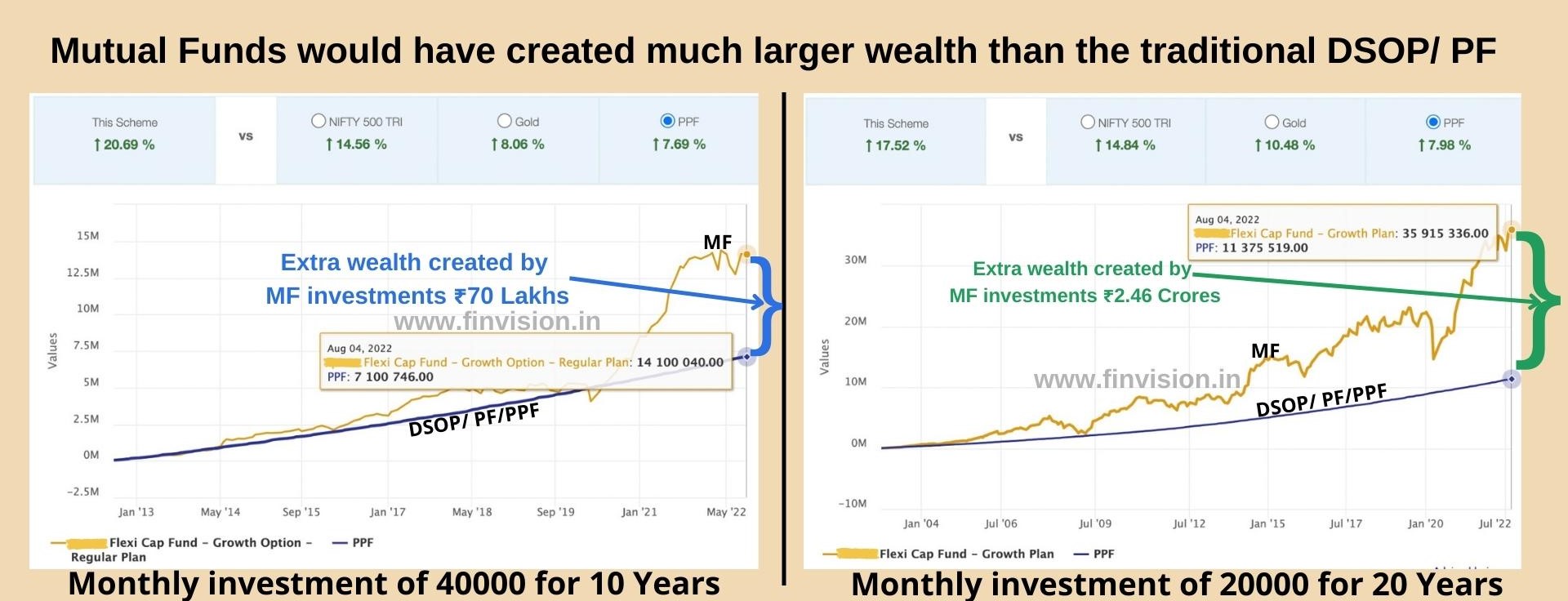

4. Chose the right investment instruments: In your journey of wealth creation, choosing the correct investment instruments is one of the the most important aspect. Here is a comparison of Maj Ram and Maj Shyam’s investments in traditional DSOP/ PF vs smart and market linked Mutual Funds.

The wealth created in MF investments is much higher than the traditional investment options of DSOP/ PF.

Key Take Aways:

- Plan today and start early.

- Small investments over long time give better returns than large investments for shorter duration.

- Market linked investments and correct asset allocation yields much better returns than the conventional ones.

Do consider these recommendations, act today, plan ahead, and redefine the idea of achieving financial independence and/or retirement. We at Finvision can help you accelerate on your journey of financial independence with best financial and investment guidance.

Call us today and get started.