India has the largest democracy and elections are an integral part. Election time always infuses short-term volatility and uncertainty into markets, and as the political landscape heats up, it is natural to be concerned about the potential impact on your investment portfolio.

Here are some of the questions that you as investors, may have:

1. How have stock markets performed during election periods in the past?

2. Should you use a wait-and-watch approach?

3. What actions could you take on your portfolios?

Let’s use the empirical data to navigate the upcoming election period with confidence and manage your portfolio for long-term success.

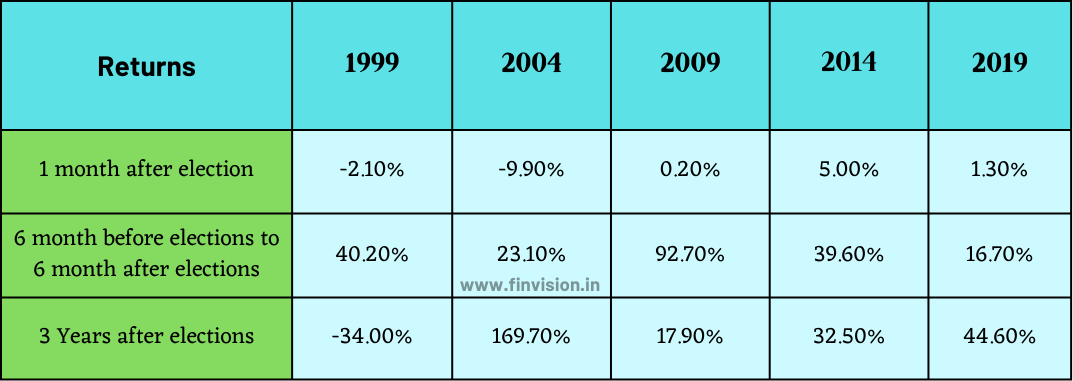

1. Historical trends of equity markets in Pre & Post-Election periods:

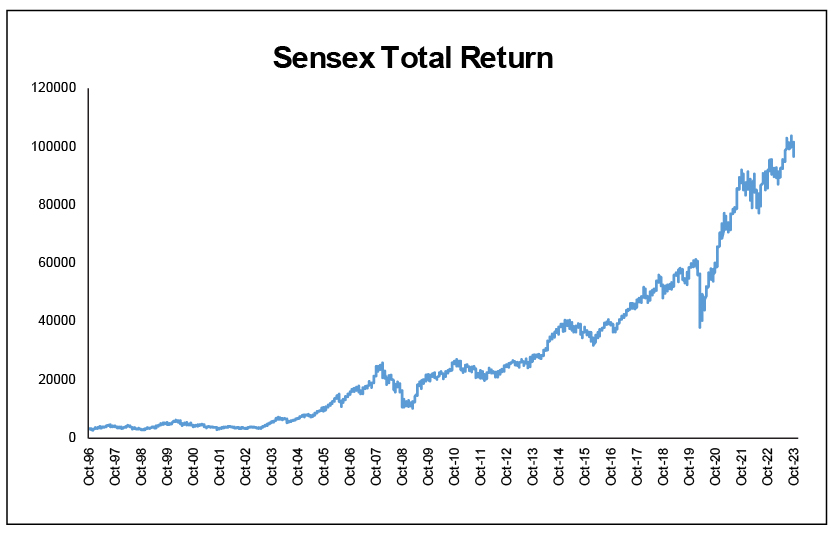

Historical data suggests that the equity markets generally perform well both pre and post-elections.

Source: Bloomberg

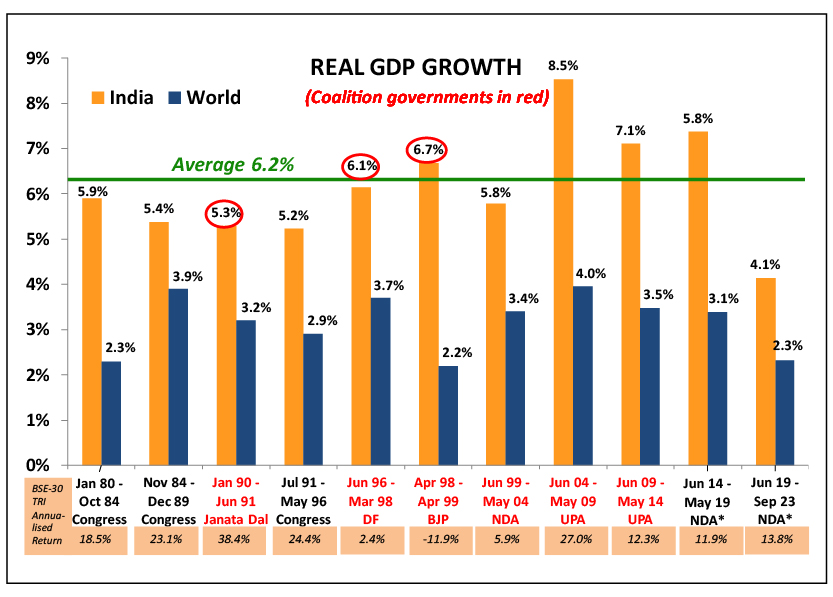

2. India’s GDP growth across 11 governments since 1980:

Irrespective of the political party in power, the Indian GDP has been growing at 6-6.5% across 11 governments over the past 44 years and in nominal terms (including inflation) between 10%-15%. This annual nominal economic growth has a correlation with market returns over the long term. Over a longer period, India’s GDP growth is reflected in the equity markets.

In the long-term: ‘Market returns ~ GDP nominal growth rate’

3. Strategy to navigate the election period volatility:

Market sentiment can go both ways ~ positive or negative. If the market sentiment is positive, it offers the opportunity to participate in potential market rallies that may follow. However, if the election results are unexpected, the market sentiment may be negative leading to a market decline.

In any case, the loss shall apply only if you resort to panic selling. Hence, it’s important to recognize that the election-induced negative market sentiment, has often been temporary, and regardless of the election outcomes, markets have historically performed much better in both pre and post-election periods.

Source: Bloomberg. Past performance may or may not be sustained in the future.

Source: Bloomberg. Past performance may or may not be sustained in the future.

Investment takeaways: If equity forms a component of your portfolio, a sound investing strategy is needed to navigate the volatility with confidence. Here are a few actionable to secure your portfolio and benefit in the ongoing election period:

- Avoid concentration in your portfolio due to inconsistent market cycles.

- Adequately diversify across market caps, investing styles, and asset classes to mitigate election-related fluctuations.

- Focus on your investments’ underlying fundamentals and intrinsic value – anchor portfolio with a value fund for safety during market shocks.

- Stick to strong fundamentals, and avoid knee-jerk reactions during elections.

“Risk is more in staying away than remaining invested during the election”