(a) Non-taxable contribution account included the amount of:

– Closing balance as on 31 March 2021

– Contribution upto ₹5 Lakhs per year(Non taxable contribution) since 01 Apr 2021.

– Interest accrued on the above or the amount as reduced by the withdrawals, if any, from this account

(b) Taxable contribution was aggregate of:-

– Contributions made in excess of the threshold limit of DSOP/PF of ₹5 Lakhs per year

– Interest accrued on above or as reduced by the withdrawal, if any, from this account

New Guidelines: With effect from November 2022, the PCDAO(Pune)/ Salary disbursing authorities have stopped taking the DSOP/PF amount beyond ₹5 Lakhs.

How will this work? When your limit of annual subscription to DSOP/PF crosses ₹5 Lakhs, CDAO(Pune)/ Paying authorities will not accept any further contributions to DSOP/PF in that Financial Year.

Implications: The threshold limit of DSOP/PF now is ₹5 Lakhs annual ie ₹41667 per month.

Alternatives and Options available for Investments:-

1. Main features of the commonly preferred/ traditional and modern investment instruments are:-

2.How are Equity Linked Saving Schemes(ELSS) & Mutual Funds better than DSOP?

Choose Equity

Tax Saving/ELSS Mutual Funds. Tax saving benefits on subscription of upto ₹1.5 Lakhs each year under IT section 80C(similar to DSOP) and lowest lock-in period of 03 yrs only. Option to invest as Lump sum or through monthly SIP, and potential to create wealth in the long-term as these are equity market linked.

Equity Mutual Funds: NO lock-in at all. Better growth and tax benefit of upto ₹1 Lakhs of tax free gains each year and effectively less than 10% tax on gains irrespective of your income tax bracket. Ideal for the investors in the 20% & 30% tax bracket.

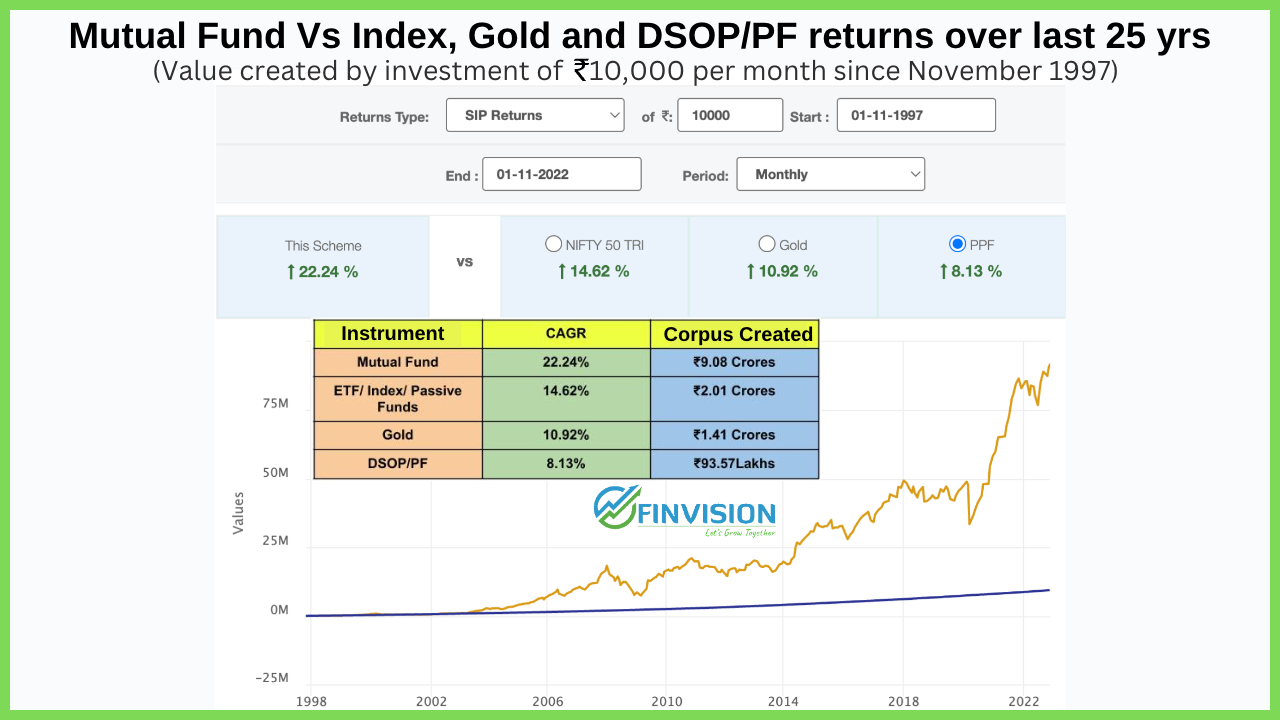

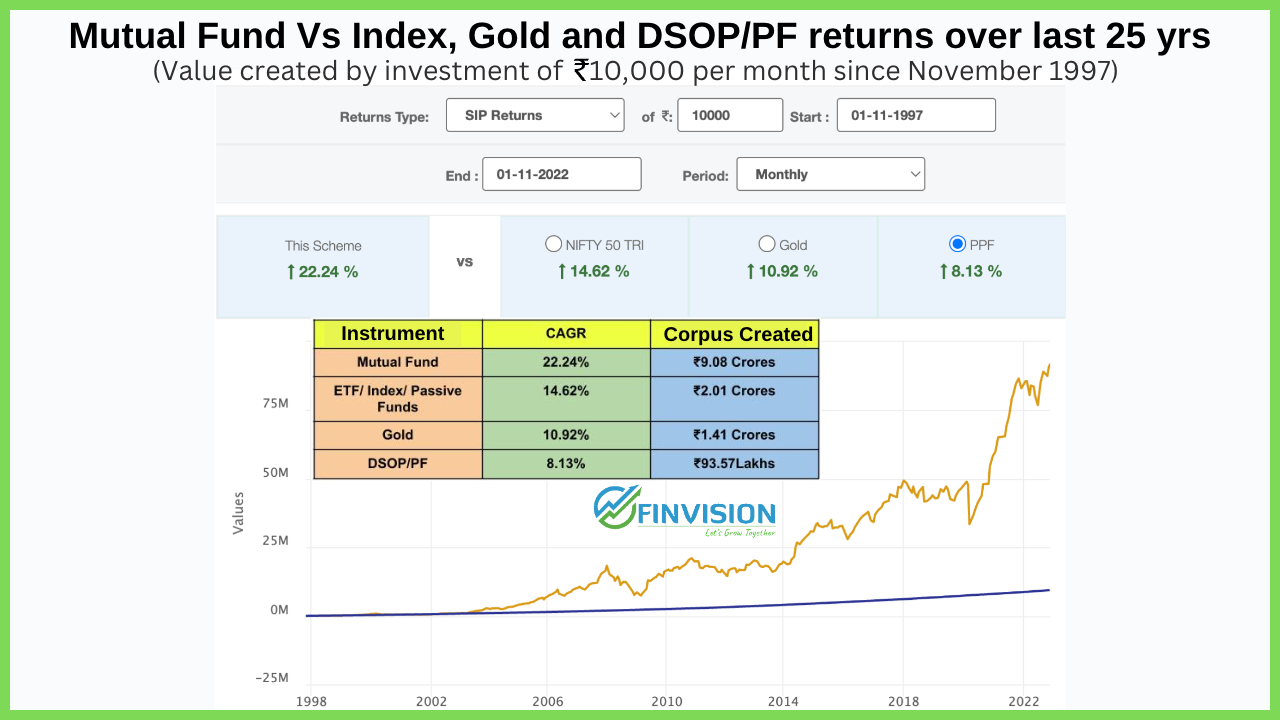

Returns from popular investment asset classes since 1982:

1. Limit or reduce your contributions in DSOP/PF to a maximum of ₹5 Lakhs per year ie ₹41667 monthly.

2. Avoid withdrawals from the already accumulated DSOP/PF corpus as it continues to earn 7.1% Tax free returns.

3. Invest the saved amount into market instruments based on your risk appetite and actively managed Mutual Funds, as they give better and tax efficient returns.

“An investment instrument should provide adequate Liquidity and Inflation beating returns(>8%)”

For further details on smart and tax efficient investment options, please feel free to contact at +91-7508055826/ 9654341212.