The military attack on Ukraine sparked a fresh bout of risk aversion because of which Indian markets witnessed a massive selloff of 5% in a day, and crude oil prices surged over 7% while gold hit the highest since early 2021. Just as the world had started recovering from the damage caused by the Covid-19 pandemic, worries have set in yet again, about a disruption in the face of already rising cost pressures and rolling back of pandemic-era measures by the central banks.

Russia is a key supplier of energy globally. One-third of European oil & gas supplies come from Russia. India accounts for a negligible (<1%) share of Russia’s crude oil exports. However, the rising crude oil prices can indirectly lead to an increase in inflation, resulting in higher input costs and drag in revenue growth. Thus RBI may have to raise rates unless the government reduces excise duties to contain fuel inflation.

What has changed on the trade front?

European Union is the biggest market for India’s exports, the supply disruptions to the EU are also likely to generate greater demand for metals, engineering goods, and so on of which India is an alternate supplier. The factors that caused India to outperform the world in 2021 shall continue to hold in 2022. In addition, the west may further be wary of imports from China for its support to Russia, hence further benefiting India from the ‘China+1’ strategy.

What else has changed since the Covid-19 crisis?

- The post-Covid-19 market rally was led by NASDAQ (US tech index) and KOSPI (South Korea). Interestingly, the same two markets were the first ones to enter bear territory (-20% zone) yesterday (albeit temporarily).

Inference: Not everything is falling and 2020 market leaders are paving the way for others.

- The pharma sector is no more leading. Digital, tech, and IT/ ITES on the index front still appear to be doing well. However, what seems to have gone unnoticed is many of the prominent US tech companies are very much in bear zone for the last many months with few plummeting as much as 95% from their 2020 highs. Even the Facebooks of the advisor’s FAANG theme have fallen by almost 50%. Many Indian so-called blue chips are also down by >50% from their recent highs.

Inference: The market theme is certainly changing.

- Investors Profile: Till October 2021, Foreign Investors (FIIs) have been the major influencers in Indian markets. However, they are no more the drivers, despite heavy FII selling of Rs 1 lakh Crores and above since October 2021. Indian markets have not fallen much. Thus, retail and domestic investors are the rising market influencers.

Inference: The profile of investors is changing, the preference of stocks and sectors of FIIs, and retail is different.

- Investment Environment: Market uncertainty over the Ukraine crisis is almost over and factored in unless the situation develops into a World War III type situation for which no action or inaction can ever help. Anxiety may however remain till the next US Fed move on rates. As for the domestic market influence, upcoming LIC IPO, and ongoing UP/ Punjab election results must be factored in.

Inference: Exit from the market or staying on the sidelines is not a prudent option and investment should be spread over the next few weeks.

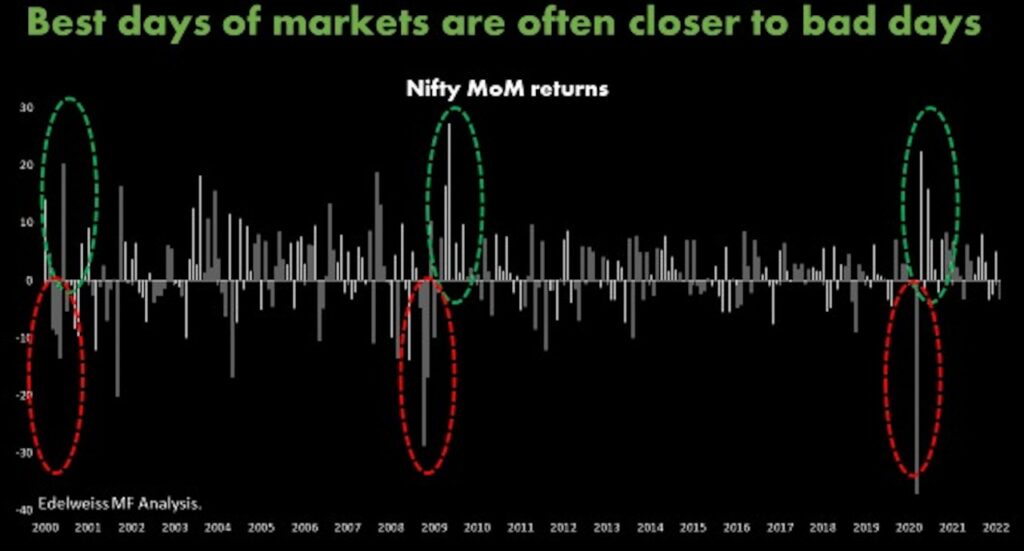

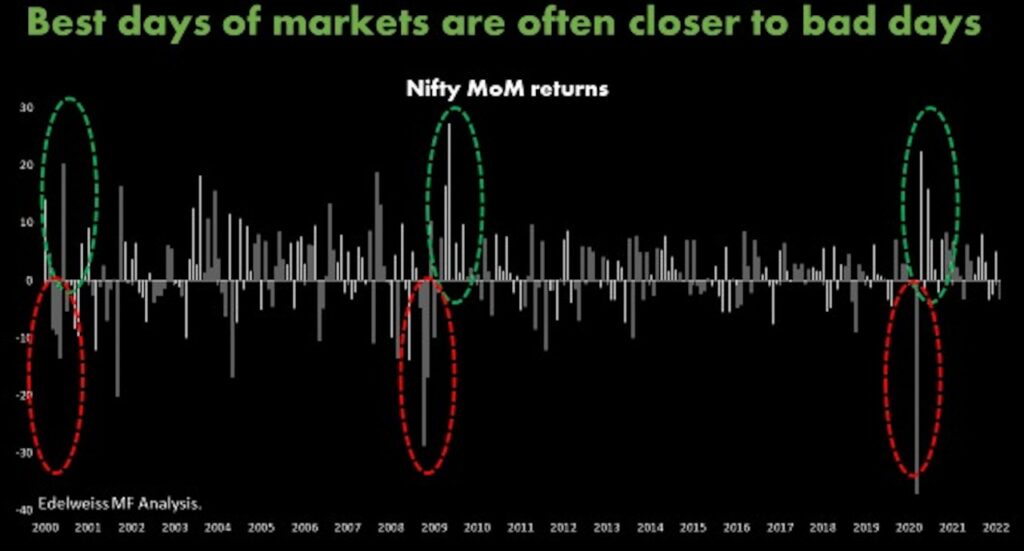

- Emotional Responses: History tells us that periods of sharp price movements tend to trigger an emotional response wherein investors perceive such movements as a threat and tend to display a “Fight, Flight, or Freeze” response. Market asset prices are set by transactions. Volatility in prices, therefore, indicates that transactions are occurring across a wide range of prices, suggesting that investors are unsure about the intrinsic value of an asset given the current confluence of risks. People displaying ‘Fight’ responses tend to increase their trading activity and confidently buy assets that have fallen in the expectation that they will recover, with little thought to the intrinsic value of those positions. Investors vulnerable to the ‘Flight’ response, will likely sell their entire portfolio and subsequently tend to remain under-invested for far too long. Those who ‘Freeze’ will do nothing even when the intrinsic value of their assets is changing and thus let go of the best opportunities.

Inference: Too much emphasis on near-term events may have a large impact on your long-term financial health. The key to staying ahead is to keep realigning your portfolios based on the intrinsic value and prospects of assets, and remaining focused on your financial goals, risk appetite and investment horizon.

Key takeaways:

- Don’t panic and stay invested amid the ongoing uncertainty. The best way to combat this uncertainty is to think long-term and tackle fluctuating market cycles through correct asset allocation & diversification.

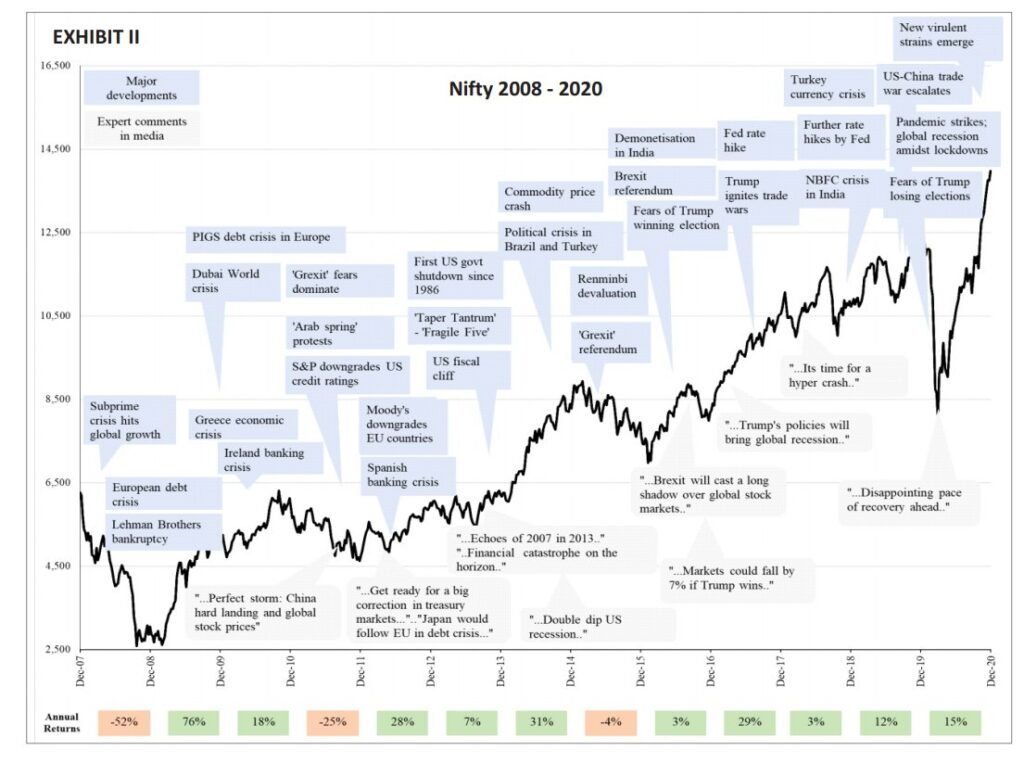

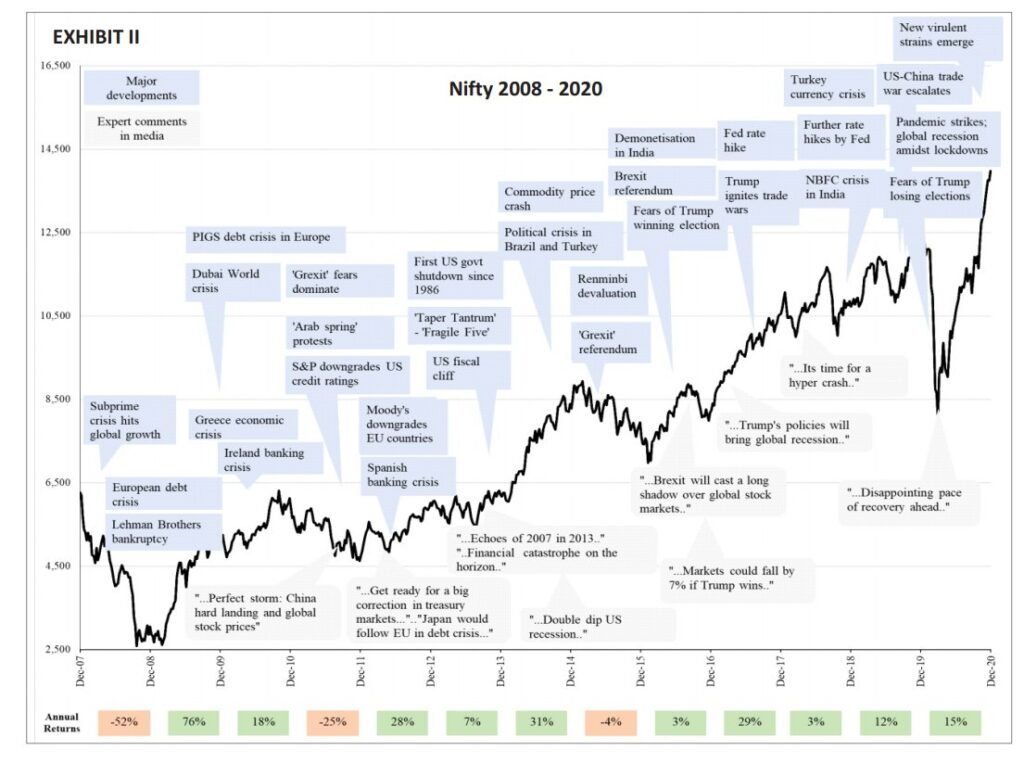

- Appreciate the fact that we are in a bull market and bull markets are known to climb many walls of worries. However, do not rush in to buy aggressively as the situation is still fluid. Contact the right financial advisor and invest strictly as per your financial goals, risk appetite, and investment horizon.

- The theme of the market has changed, so choose accordingly. Revisit your portfolios for correct asset and sub-asset allocation and re-alignment.

“Long term investment doesn’t mean buy and forget”

- The market tends to bounce back. Unless you are a trader and know what you are doing, it is crazy to react in this kind of market and do things indiscriminately. Don’t lose sight of the long-term opportunity. While markets may remain turbulent in the near term, once the situation normalises, India’s relative strengths will come to the fore. History tells us that “Buy when there is blood on the streets” is a good strategy, particularly during geopolitical crises. Saddam Hussein’s invasion of Kuwait, the Kargil war, Russia’s annexation of Crimea have all been good buying opportunities. History may repeat itself.

How are we positioned?

We are continually reviewing the portfolios to ensure that they remain robust to a broad range of potential economic outcomes rather than buying and forgetting or getting influenced by those that dominate the headlines. Over the past few months, we’ve readjusted the asset allocation to investors’ benchmark allocation. This proactive stance has helped us to protect the downside risk as the portfolios witnessed volatility and drawdown much lesser than the benchmark and peers. The ongoing market correction does provide us few more opportunities to take advantage of volatility and distortion in valuations.

“Sometimes the prevailing price offered by Mr. Market will be above that intrinsic value and sometimes below. Herein lies opportunity”