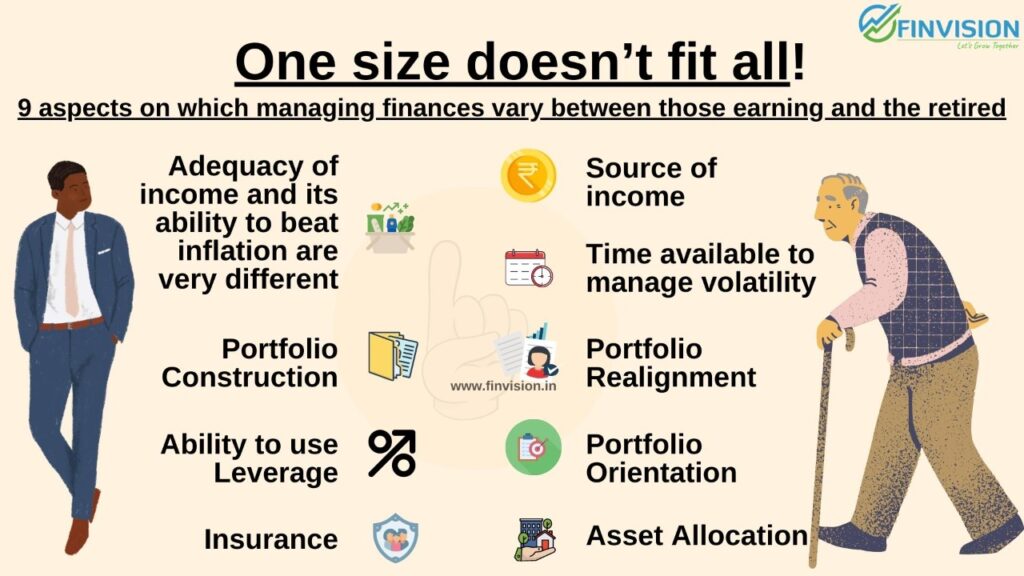

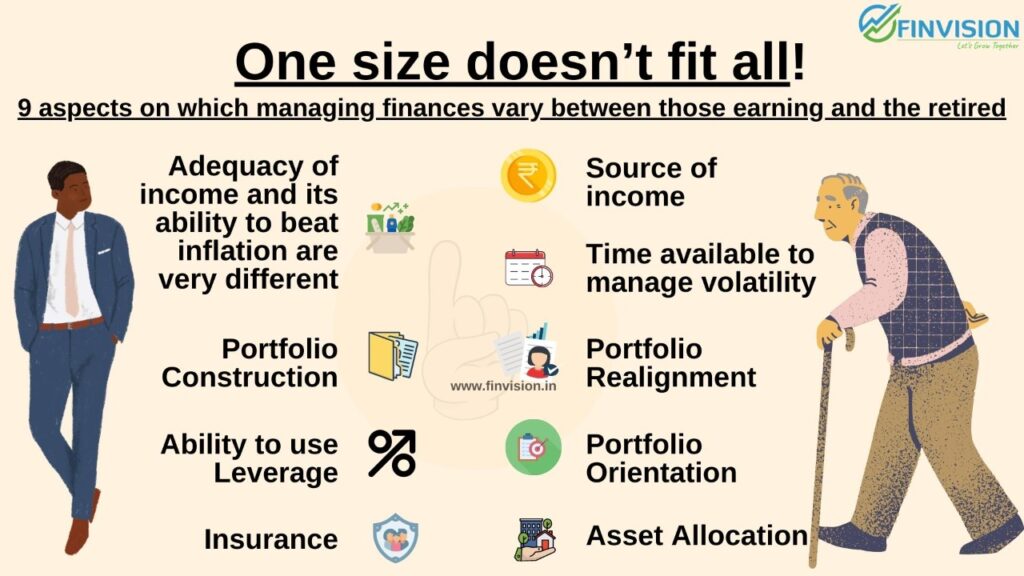

One size doesn’t fit all

Personal finance principles aren’t universal and in addition to individuals financial goals, risk appetite and investment horizon, one’s life stage also has major influences on one’s personal financial decisions. Here are nine such aspects on which the management of finances between the earning phase and retirement phase differs:- 1. Source of income: In the earning phase: […]

7 Myths about wealth management that you must know

Myth 1: Earning more money is a sign of successReality: Just earning money will not create wealth, specially so if you continue to increase your expenses. Saving, investing and having sources of passive income is more important to create wealth in the long term. Myth 2: Bank FDs and Gold are best investmentsReality: Bank FDs […]

Why do FD & loan interest rates change?

An interest rate is the cost of borrowing money. Or, on the other side, it is the compensation for the service and risk of lending money. In both cases it keeps the economy moving by encouraging people to borrow, to lend, and to spend. The prevailing interest rates are always changing, and different types […]

Introducing emergency fund in 02 minutes

In continuation to our last week blog where we talked about importance of investing. In this blog let’s understand what should you do before you start investing. The most important prerequisite to investing is having an Emergency fund. What is an Emergency Fund? As the name suggests, an emergency fund is a fund that you can […]

7 Things to do before hitting 40

For most of us, reaching the age of 40 is like entering a new phase in life as your obligations will almost certainly increase. Here are the seven major financial decisions you should consider before celebrating your 40th birthday. 1. Have an adequate emergency fund: As life can be unpredictable, and preparing for the unexpected […]

Filing of Income Tax Returns for the Current Year

1. We are in the process of filing the Income Tax Returns for the current year. 2. In case you have not filed your ITR yet. The process for filing the same through us at FINVISION is as under.Important note for Retired Officers: In case you have retired between 01 Apr 2021 and 31 Mar […]

5 Biases that could be hurting your investments

Wealth creation is a long-term game, and its rules aren’t as complicated as they appear. Just like any other area in life, consistency and discipline are at the core of successful investing. Though, most of us do try to approach investments logically, however, what often comes in the way of your perfectly planned investments are […]

Important to know this before you buy an insurance policy-1

Insurance offers protection against unforeseen and adverse circumstances like death by paying a nominal premium. However, with the various types of insurance plans available, many people usually get confused in finding the best suitable plans for their requirements. Through this blog, let’s understand few popular types of life insurance plans and ideal time to buy […]

What should long term investors do about market volatility?

Given the risk-off sentiment globally, the markets across the world have plunged. It is likely that the current month could go down as the worst month for not only the equities but for all the investment asset classes since March 2020, when markets crashed pandemic’s outbreak. If the ongoing correction drags on, this will be […]

Timing the markets vs Time in the market: What’s the better approach?

For the last six months and to be precise since 19 Oct 2021, markets have been consolidating with heightened volatility. The reasons could be many, however, such movements usually prompt most investors to speculate if a sharp correction is around the corner. Leading to the dilemma of whether one should book profits and protect the […]