Market continues to reward the proactive and agile investors who realign their investments to the developing market realities. We recommend conducting a annual portfolio review in following 7 steps:-

Step 1: Check how you are doing

(a) Are you on track to reach your financial goals?

(b) Are you saving at least 20% of your gross income?

(c) Compare the annual returns of your portfolio to the market benchmark index returns.

Step 2: Assess your asset allocation

(a) In your portfolio mix of stocks, debt, gold and cash, what is the % age of each component?

(b) What is your benchmark asset allocation? And this benchmark should have been arrived at after detailed considerations of your income streams, risk profile, investment horizon, liabilities, etc.

(c) Compare your actual asset allocation to your target/ benchmark asset allocation.

Step 3: Assess adequacy of your contingency fund

(a) Calculate your contingency fund requirements? And think through your options, if you need to tap.

(b) Recommended contingency fund levels are:-

– Regular salary individuals: 3-6 months of living expenses

– Businessmen/ contractual employees: 12 Months

– Retired: 6-24 months

Step 4: Assess your equity and mutual fund positioning

(a) Correct asset allocation and diversification between debt and equity will always be the key determinant of your portfolio performance.

(b) Keeping with the emerging market realities, check your positioning.

(c) Based on your risk profile and investment horizon, correctly re-allocate your investments among the Large/ Mid/ Small Caps. May also consider some sector specific exposures and overseas investments to enable hedging during regional under-performance.

Step 5: Evaluate your debt exposures

(a) Review your positioning to ensure that your portfolio delivers when and what you need.

(b) For two years, debt fund returns have been less than 5% and future prospects aren’t bright either, hence, it’s high time you look for alternatives.

Step 6: Review and monitoring of your holdings

(a) Take a closer look to see whether your holdings have prospects.

(b) Assess each of your holdings not only for technical aspects but also for the fund house strategy/ management changes, agility exhibited, timely realignment, detailed composition, etc.

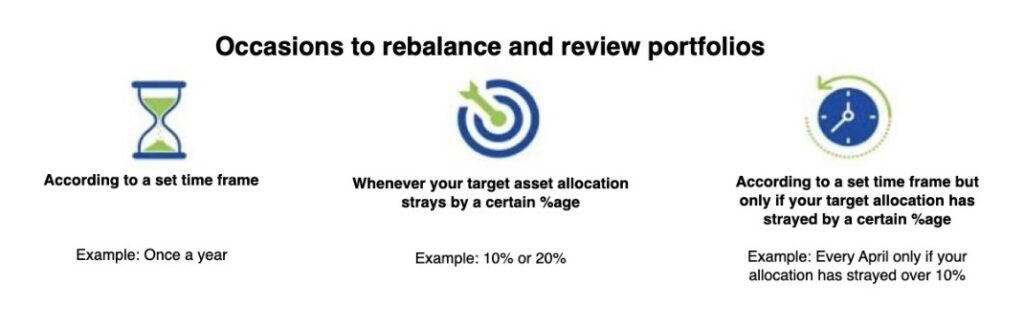

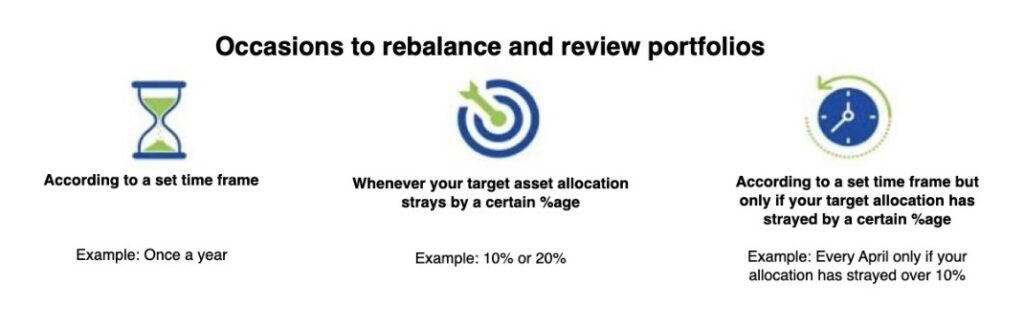

Step 7: Make changes judiciously

Any action on any of the conclusions you drew from your fact-findings in steps 1-6 should depend upon:-

(a) Type and severity of the issue, as well as your life stage and situation.

(b) Parameters laid out in your investment policy statement.

(c) If you don’t have a financial or a goal based investment plan, we can help you to create one as per your standards and needs.

(d) Making changes in portfolios can be more pressing if you’re close to your retirement and life goals and your portfolio doesn’t have appropriate assets to tide you through the possible market scenarios.

(e) Consider transmission losses and tax implications of your actions, at the same time do harvest the LTCG for the current FY.

Professional Review

From drawing up a proper financial plan to monitoring investments and taking corrective action whenever required, needs a lot of application. It also entails working with various tools that facilitate decision-making. A professional advisor with sufficient exposure and knowledge is a perfect choice in such circumstances. Getting professional help to review and manage investments is always a good idea and can contribute positively to your financial health.

2 Responses

Very useful and practical contents for those who are novice or don’t have much idea about investment.

Thanks

Do share with others and help them in decision making.