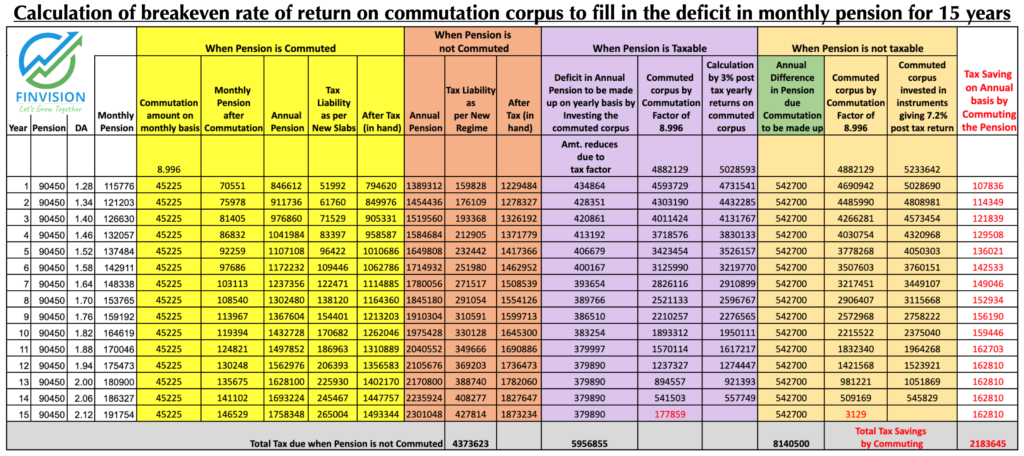

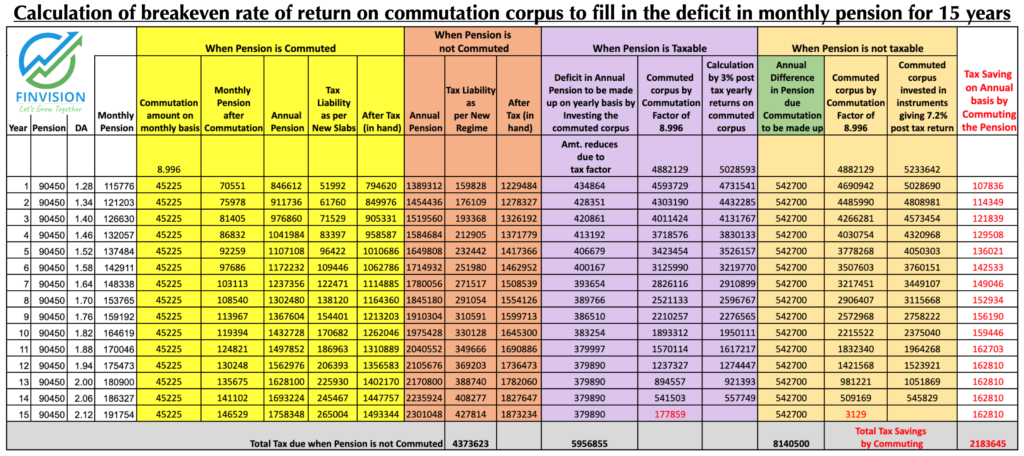

Commutation of pension is one of the most crucial decisions that officers retired or retiring from the Indian Armed Forces have to make during premature retirement or superannuation, and the factors that need to be considered are not only financial but many intangibles. Though, there can not be a straight answer to the question, here is our attempt to simplify the decision matrix on whether to commute the pension.

Financial Factors: For estimation purposes only, we are assuming the details of an officer proceeding for premature retirement after 24 years of service to the Indian Armed Forces:

- Basic Pension is ₹90,450.

- Applicable Commutation factor is 8.996.

- 50% pension is commuted i.e corpus received = ₹(90,450 X 8.996 X 12)/2 = ₹48,82,129.

Note: The pensioner will continue to receive Dearness Allowance/Dearness Relief, even on the commuted portion.

Assumptions:

- DA/DR is 28%.

- Annual rate of increase in DA/DR for the next 15 years will be 6%.

- Pensioner opts for the new tax regime, and current income tax rates have been applied.

- If you have any major liability that needs to be paid off, you must commute.

- If you are likely to pick up a job or have a source of regular income from any business etc. to fill up the gap created in regular monthly pension due to commutation, you must commute.

- PMR and officers retiring at younger ages should prefer to commute, unless commutation of pension is ruled out for other more compelling reasons.

- The commuted corpus comes as tax-free and in an unfortunate demise of the pensioner. The pension to the spouse gets restored/ reverted to full pension.

- The available commuted corpus at hand provides chances of availing opportunity cost.

Conclusion: Based on the financial factors alone, pensioners should always prefer to commute their pension. Why? For a simple reason which is that, the required breakeven rate of return of 3% is possible even with the Fixed Deposits offered by banks such as SBI (current SBI FD rates are 5.1% pre-tax and 3.47% post-tax).

7 Responses

I need to re align my financial investement s

Yes

In case we can help. Please do call us at 7508055826.

Thanks

Good input however question now is what percentage of pension to be commuted

Thanks and hope it did add some value.

We recommend 50% commutation. For more you may call at 7508055826.

Do Share it with others to help.

Regards

Great analysis of my commutation of pension

Thanks and hope it did add some value. Do Share it with others to help.

Regards

Col Sandeep Mahalwar(retd)

Thanks. Do share it in your groups for others to benefit.