Why do you need a proper Financial Plan? Why won’t simple investments and SIPs work?

A financial plan enables you to construct a road map to achieve all the financial goals and helps you build a contingency fund for any unforeseen events. It ensures that you are well equipped to deal with dynamically changing circumstances at a personal and macro level. Ad hoc investments into Fixed Deposits and Mutual fund SIPs often leads to inefficient utilisation of your financial resources.

1. Management of cash flows and budgeting.

2. Efficient management of your debt and loans.

3. Identify and set pragmatic financial goals.

4. Streamlining of your existing Investments.

5. Correct asset allocation.

6. Weeding out inefficient financial products.

7. Selection of right instruments.

8. Calculating the right Insurance cover.

9. Develop a regular savings habit.

10. A blueprint to your long term financial goals.

How to go about it?

Step 1 – Fix your relationship with money: By buying only the things that you need. Because “If you buy things you do not need, soon you will have to sell things you need.”

Step 2 – Set clear definitions of your goals and execute a financial plan: Classify your long-term and short-term financial goals and channelise your income into productive avenues. Thereby, avoiding ad-hoc investments while remaining focussed on your prioritised financial goals. To again quote Warren Buffett, “Do not save what is left after spending; instead spend what is left after saving.”

Step 3 – Save systematically to build your wealth over the long term: To attain financial freedom, above all, you have to be patient. Wealth building is a gradual process. Your goals will probably look pretty big once they are quantified. That kind of money takes years to build, and everybody starts small. Investing regularly also helps in dealing with market volatility.

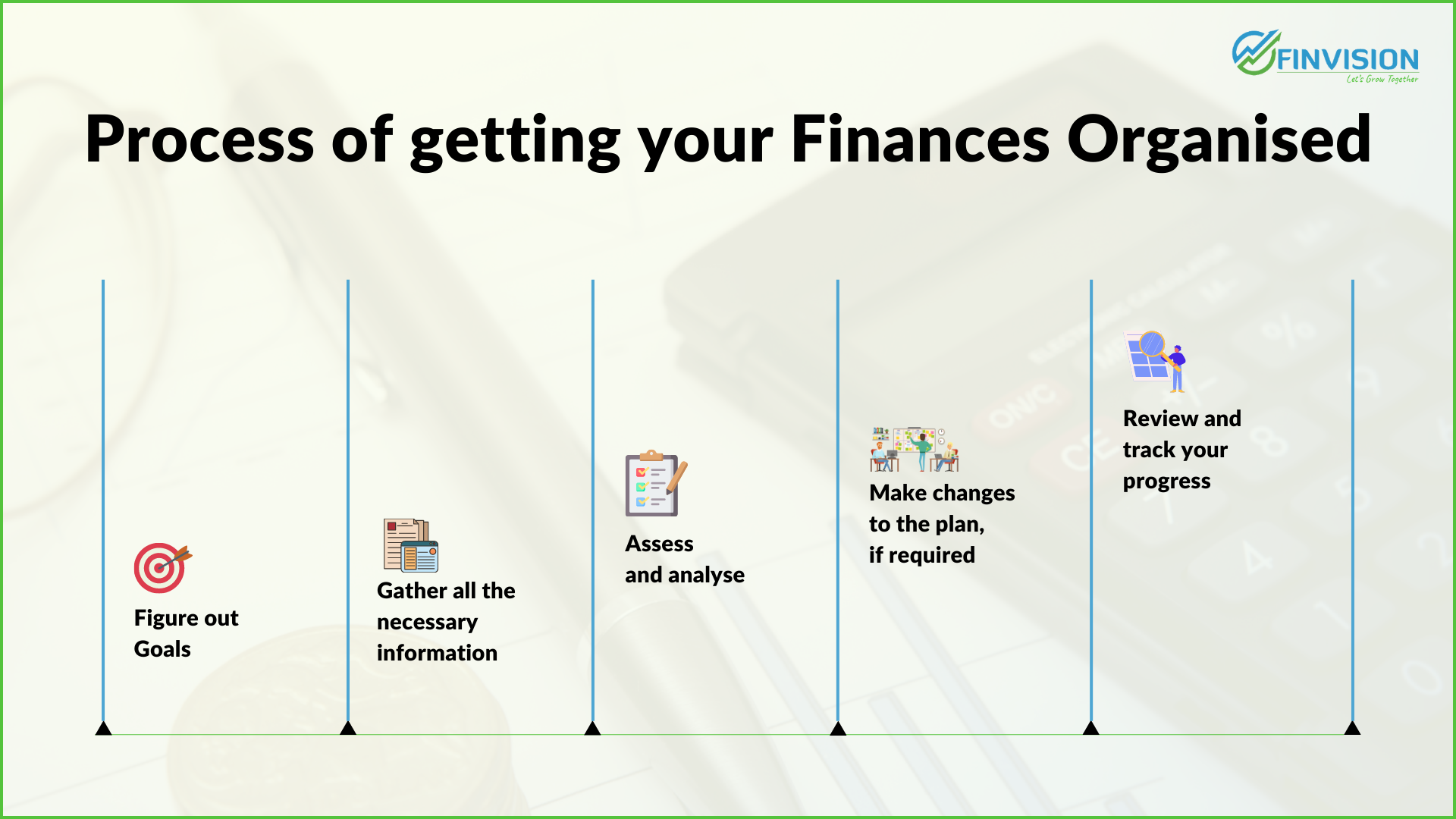

What to expect from Finvision?

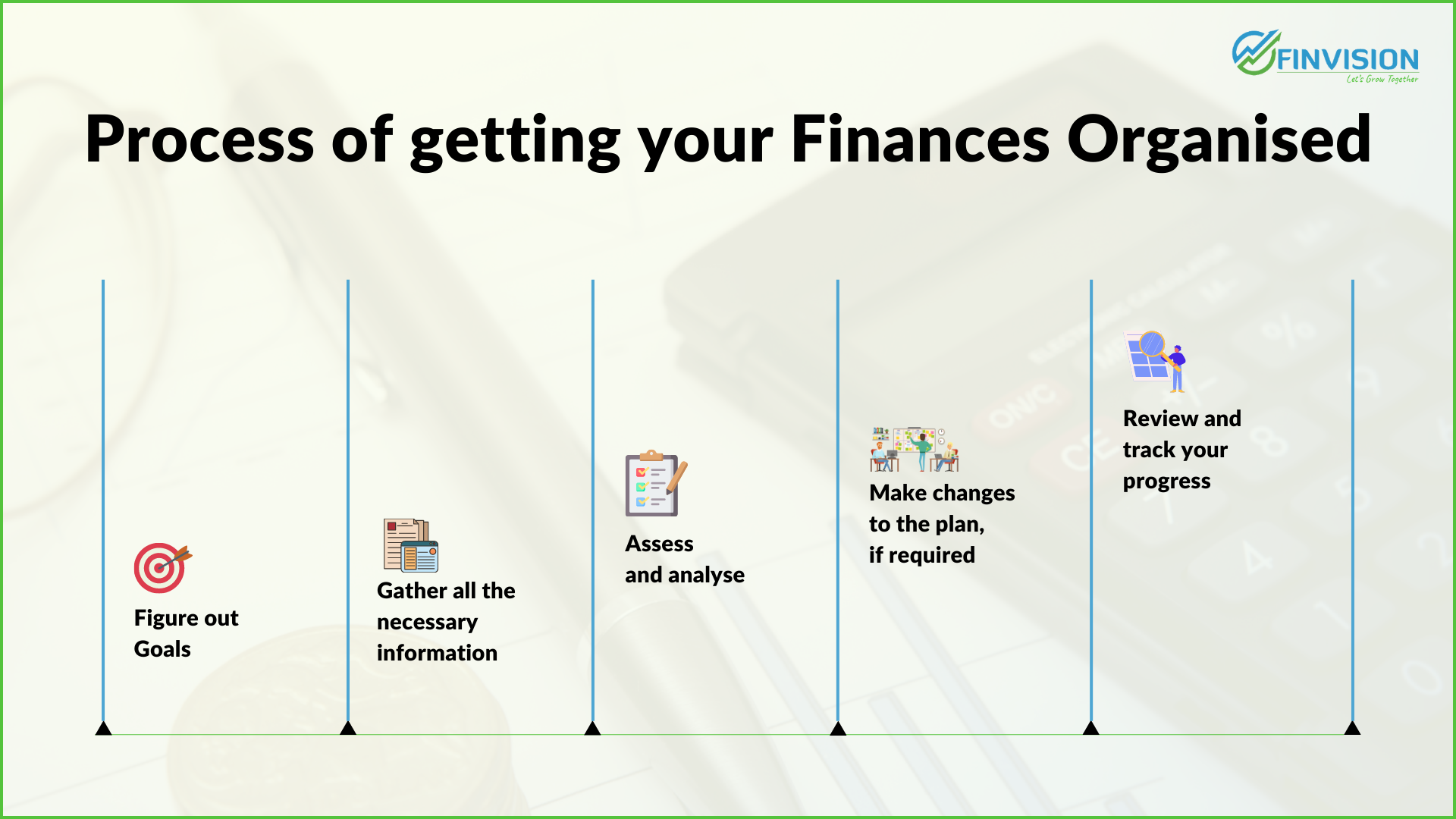

When you decide to engage with us for your financial planning, you can expect us to serve you with the following;

– Assessment of all your Financial Goals (retirement, children’s education, their marriage, housing, & so on).

– Prioritisation of your lifestyle goals.

– Check goal affordability and rationalisation.

– Evaluate your risk tolerance and appetite.

– Review, realign and revitalise your existing investments.

– Present a customised asset allocation for each of your goal/ goal groups.

– Provide a goal based investment plan.

– Periodic review of the plan.

– Life and Health Insurance needs and advice suitable products.

– Contingency fund requirements and advice on ways to create.

Finvision is of the view that everyone needs a financial plan, irrespective of whether you earn ₹20,000 per month or ₹2 Lakh per month. Also, recognise that achieving financial nirvana isn’t as difficult as it is often made out to be. To get there, all one needs to do is, construct a viable financial plan and be determined about achieving it. Many of you might not have the time and expertise to plan and execute your own financial plan, Hence, it would be prudent to invest in the advice of an expert/ financial planner to help you plan and manage your finances in a better and optimised manner.

Hope you are investing with a proper financial plan? In not, connect with us at #TeamFinvison for all your Financial & Retirement planning, Investment, Insurance and Tax optimisation needs.

Don’t forget to share the blog with friends, follow us on LinkedIn and subscribe to our newsletter: https://www.linkedin.com/company/80388138/admin/ and join our Telegram channels: https://t.me/+-trZbgtThPw2Y2E1 to stay updated.

Link to Finvision YouTube Channel: https://www.youtube.com/channel/UCW-avyIZvPg2meoXk3X4nQA