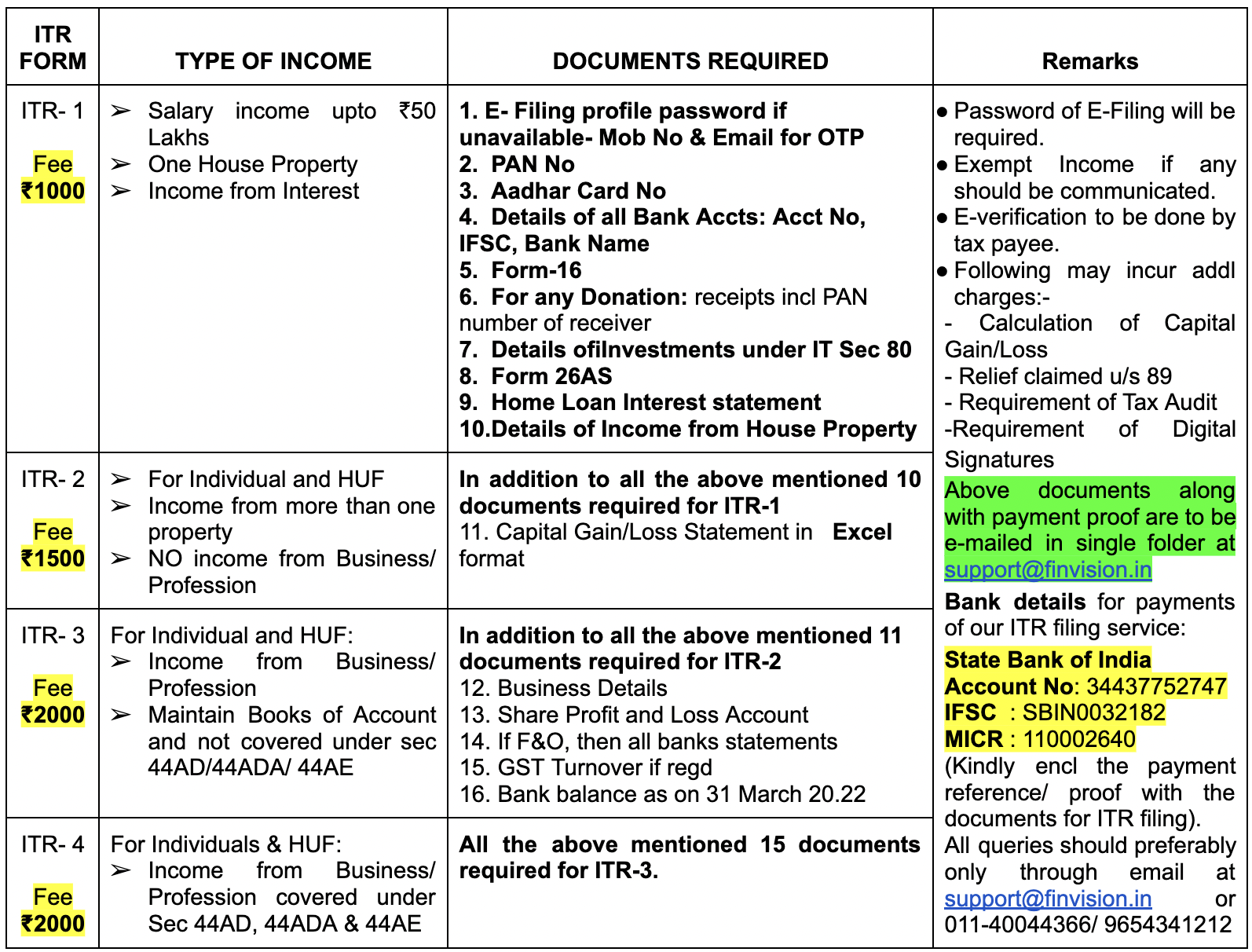

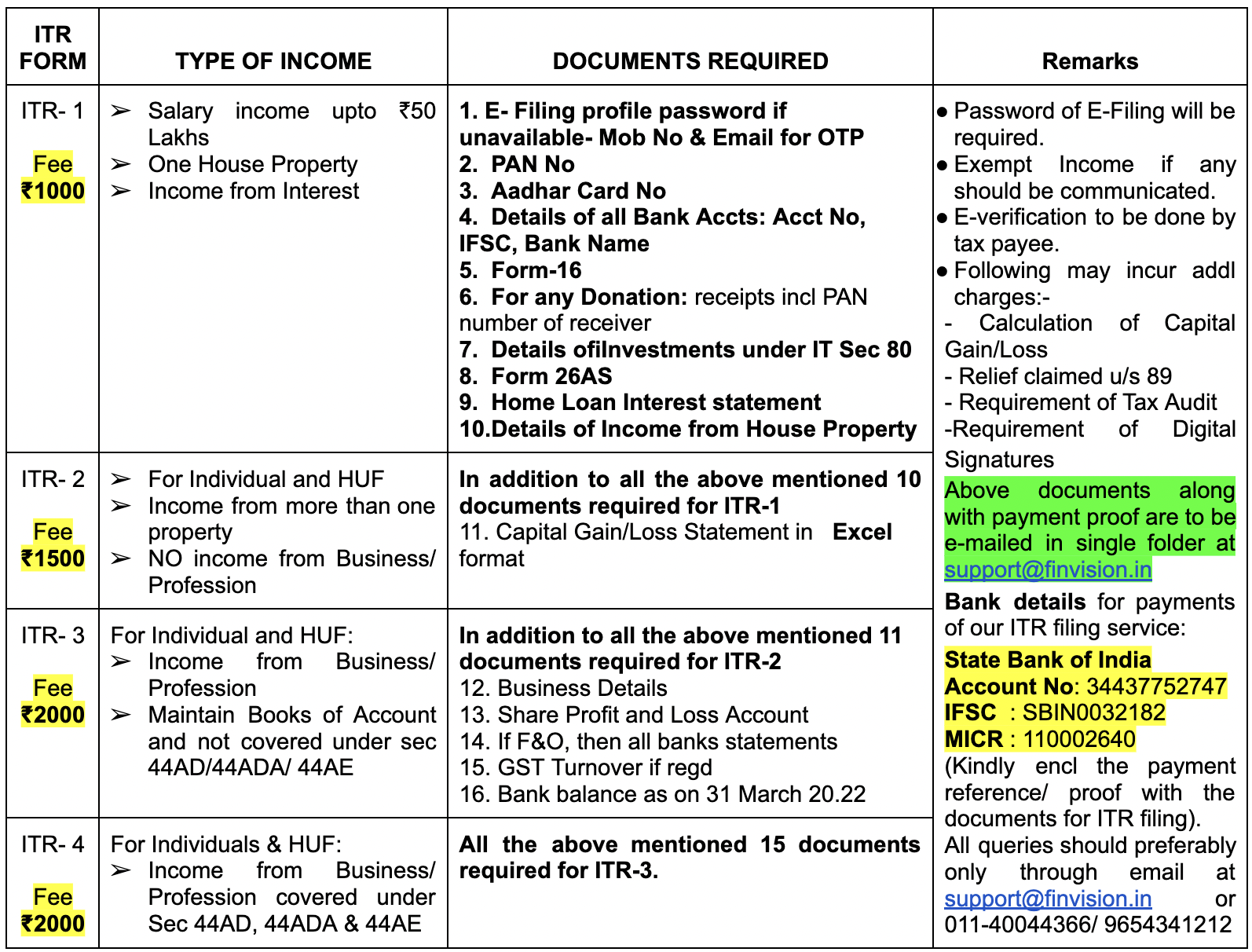

1. We are in the process of filing the Income Tax Returns for the current year.

2. In case you have not filed your ITR yet. The process for filing the same through us at FINVISION is as under.

1. Total retirement emoluments received during the period 01 Apr 21 to 31 Mar 22 including Leave Encashment, Gratuity, Commuted Pension, AGIF/NGIS/AFGIS corpus and DSOPF. All of these are tax-free but need to be reflected in the ITR.

2. One time ECHS payment deducted from gratuity is eligible for a tax benefit of ₹25-50K under Sec 80D.

Please Note: All the details and communication for ITR filing shall be done through Email at support@www.finvision.in or at 011-40044366.

Looking for investment and wealth creation options? Contact us at info@www.finvision.in or at +91-7508055826

Join our social media initiative and stay updated on all personal finance matters: https://t.me/RMiB6j1HPec1ZjVl1

One Response

Sir,

I wish to file ITR for the AY 2022-23 through Finvision.

I have been employed in State Govt of West Bengal after retiring from the Army.

The following details are available with me.

1. Form 16 part A and B for the period Apr 2021 to Dec 2021 from SBI, for pension

2. Form 16 part A and B for the period Jan 2022 to Mar 2022 from SPARSH, for pension

3. Form 16 part A and B for the FY 2021-22 from Govt Treasury, for Salary

4. TATA AIA Insurance premium receipt for ₹3,00,000/- for claiming max exemption under section 80C

5. Rent receipts from the house owner of the flat where I stay.

I have some income from Post Office Senior Citizen’s Saving Scheme and Monthly Income Scheme, but do not have the details of TDS

I have some income from dividend from HDFC Mutual Fund, but do not have the details of TDS

I have some income from Fixed Deposits, but do not have the details of TDS.

Please let me know if I may share the details from ser 1 to 5 above to support@www.finvision.in today.

Please intimate your service charges for ITR filing and also for management of Mutual Funds for future.

– Col Sudarsan.