Why give the same type of gift, year after year, when you can give a financial gift of lasting value?

Discuss your financial health as a couple: Use the Valentine’s Day mushy candlelit dinner as an opportunity to openly converse about your financial health, apprehensions and aspirations. Do away with gender stereotypes and be equal partners in financial management as a couple. Openly discuss your financial goals, cash flows, assets & liabilities and plan out an investment strategy. Plan your finances, the sooner, the better.

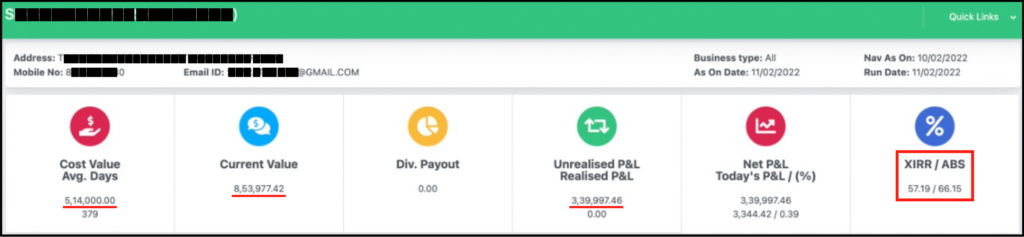

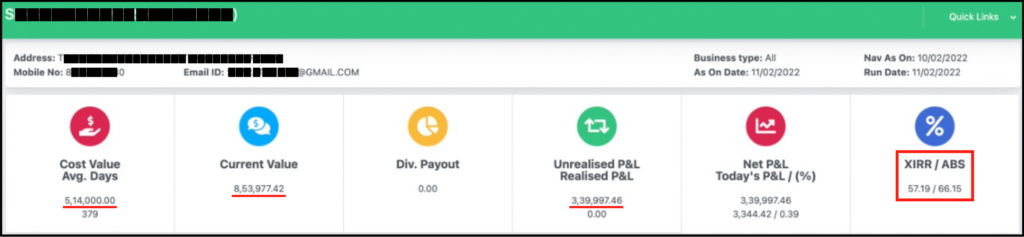

Offer a Savings Match: If your partner struggles to build an adequate corpus, offer a one-time or continuous savings match to help jumpstart their investment efforts. Only do what you can afford. If your partner can contribute ₹10,000 to their savings every month, see if you can match this and give an additional ₹10,000. Even though people are generally diligent about contributing to Provident Fund and Insurance, they often miss out on investment in growth options. Here is one example of a couple that started investing ₹20,000 per month in Finvision SmartSIP (Systematic Investment Plan) exactly 2 years back. Our personalised strategy for their portfolio generated optimised wealth for them, in this case 57.19% annualised returns were achieved with correct asset allocation, risk management, and timely realignment.

Invest in the future: Some people want to start a side business or continue their education. But unfortunately, they aren’t able to make the first move due to lack of resources. Rather than giving jewellery or another lavish gift, invest in your loved one’s future. Consider the needs of your loved one, and then plan your financial gift accordingly.

Ensure financial safety for your family’s future: Life may not be permanent but some measures can ensure your love remains eternal. This Valentine’s Day opt for a Term Insurance Plan for yourself and your spouse thereby safeguarding the family’s future. Show that you care not merely in words but with financial planning even for the times where you may not be around.

Why give a piece of cake when you can purchase a part of the bakery itself? If you are young, and a proactive investor with a high risk appetite then consider buying shares of companies or brands loved by your partner. For illustration: Consider purchasing shares of a leading food brand over ordering a pizza, a fashion brand over some exotic party wear or an automobile company instead of a new car. Such gifts can be an exciting way to begin your investment journey together as a couple while being part of your favourite brand’s success story. Plus, there’s the excitement of watching your stock increase in value.

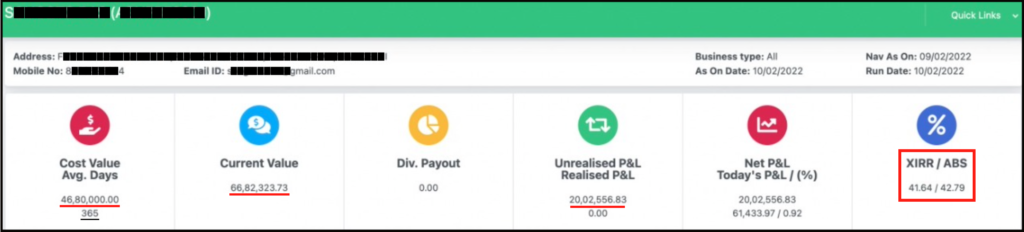

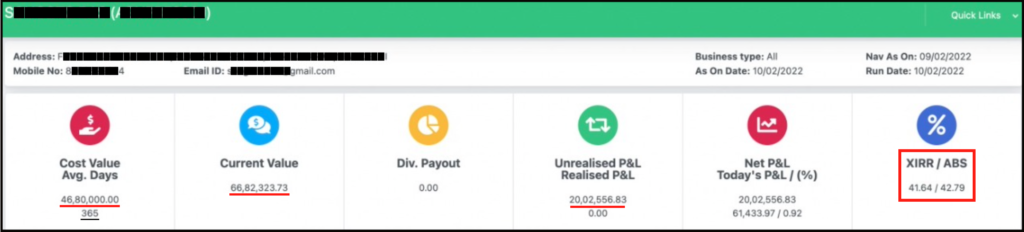

Give the gift of Mutual Funds: In the long run, this gift comes with the best returns. If you are building your retirement corpus and desire a balanced long term wealth creation, and if you want a stress free life as an investor, then ‘Mutual Funds is the way to go’. We like to back our words with hard evidence. Same time last year, one of our investors gifted his family with an investment portfolio that has borne stellar 42.79% returns with our guidance, correct asset allocations, continuous monitoring and active management of funds.

Note: Nifty returns in the last one year is just 13.07% which infers that our strategy yielded an alpha (extra returns) of 29.72% from last to this Valentine’s Day.

Action point: This Valentine’s Day stress on the financial well being of your partner and do so with a gift that lingers the joy of pleasant memories for years to come. Evaluate your financial health and convert your savings into smart investments. Exploit this once in a lifetime opportunity to invest in the Indian market when the economic progression is expected to touch double digits. If you find it hard to chalk out a plan, contact us to channelise your money affairs.